Exploring Brandon Miller Real Estate Equities: A Smart Investment Path

Detail Author:

- Name : Chesley Rodriguez

- Username : jadon89

- Email : ureichert@hotmail.com

- Birthdate : 2004-10-02

- Address : 11857 Christine Estate Suite 876 Sadyemouth, MN 75913

- Phone : 1-458-431-1197

- Company : Waelchi-Nienow

- Job : Architectural Drafter OR Civil Drafter

- Bio : Non illo sit non corrupti exercitationem. Nobis blanditiis et ratione. Velit quo excepturi omnis necessitatibus sed perferendis.

Socials

facebook:

- url : https://facebook.com/phane

- username : phane

- bio : Aut temporibus cupiditate quibusdam consequatur.

- followers : 2518

- following : 2683

tiktok:

- url : https://tiktok.com/@presley.hane

- username : presley.hane

- bio : Nihil rem modi omnis dignissimos incidunt magnam.

- followers : 1962

- following : 1396

Putting your money into real estate, you know, can feel like a really big step for many people looking to grow their wealth. It’s a way to build something lasting, that is kind of what draws folks in, apparently. So, when we talk about brandon miller real estate equities, we're looking at a specific way to get involved in property, actually, without necessarily buying a whole building yourself.

This approach lets you own a piece of valuable property assets, more or less, without all the hassle of being a direct landlord. It’s a pretty interesting path for those who want to benefit from property’s stability and potential for growth, yet want a simpler way to manage things. You see, it’s about smart choices in a big market, and it offers some unique benefits for your financial well-being.

For anyone thinking about where to put their hard-earned money, real estate equities present a compelling option. They offer a chance to diversify what you own, potentially earn income, and see your money grow over time. It’s a strategy that many, including those who might follow an approach like Brandon Miller's, find quite appealing, especially with today’s market conditions.

Table of Contents

- Who is Brandon Miller?

- What Are Real Estate Equities?

- Brandon Miller's Approach to Real Estate Equities

- Getting Started with Real Estate Equities

- Frequently Asked Questions About Real Estate Equities

Who is Brandon Miller?

When we talk about someone like Brandon Miller in the context of real estate equities, we're thinking about a person who really gets how property investments work, you know, on a deeper level. This isn't just about buying a house; it's about understanding the financial structures behind big properties. A person like Brandon, perhaps someone who grew up in a place like Brandon, Florida, where community and growth are very visible, might develop a keen sense for what makes property valuable.

This individual, in a way, would be someone who has spent years learning the ins and outs of the property market. They would have seen many cycles, good times and bad, and learned how to make smart moves regardless of the current situation. Their insights would come from practical experience and a real desire to see investments succeed, not just for themselves but for others too.

Such a person would typically focus on creating lasting value through careful selection and thoughtful management of real estate assets. They understand that patience and a clear strategy are quite important. It’s about building a portfolio that can weather different economic conditions, offering stability and growth over the long run, which is really what many investors seek.

Personal Details

For an illustrative figure like Brandon Miller, here are some personal details that would shape their approach to real estate equities:

| Attribute | Detail |

|---|---|

| Name | Brandon Miller |

| Primary Focus | Real Estate Equity Investments, Portfolio Strategy |

| Years of Experience | Over 15 years in property finance and investment |

| Investment Philosophy | Long-term value creation, diversification, risk mitigation |

| Key Strengths | Market analysis, asset selection, strategic partnerships |

What Are Real Estate Equities?

Real estate equities are, in simple terms, ownership interests in real property or companies that own real property. Instead of directly buying a building, you own shares in a company that owns many buildings, or you might own a piece of a larger property project. This allows you to get the benefits of real estate ownership without all the direct responsibilities, you know, like fixing a leaky roof.

This investment type is pretty popular because it offers a way to get into the property market with more flexibility and, quite often, with less capital than buying physical property outright. It's a method that provides liquidity, meaning you can sell your shares more easily than selling a whole building, which is a big plus for many people.

The value of real estate equities can grow as the properties they represent increase in value, or as the income generated from those properties goes up. They can also pay out regular income, like dividends, which is rather appealing for those looking for steady returns. So, it's a dual benefit of potential appreciation and income generation.

Different Types of Real Estate Equities

There are several ways you can get involved with real estate equities, each with its own characteristics. Understanding these different types is pretty important for making choices that fit your financial goals. You've got options, you know, that cater to different levels of involvement and risk tolerance.

One common type is Real Estate Investment Trusts, or REITs. These are companies that own, operate, or finance income-producing real estate across a range of property types. They trade on major stock exchanges, just like regular stocks, which makes them very accessible for everyday investors. They are required to distribute most of their taxable income to shareholders annually, which means they offer a steady income stream, apparently.

Then there are private real estate funds. These are typically for bigger investors, like institutions or very wealthy individuals. They pool money to invest in various property projects, which might include development, acquisitions, or even distressed properties. These funds are usually less liquid than REITs, meaning your money is tied up for a longer time, but they can offer potentially higher returns.

Another option is real estate crowdfunding platforms. These platforms allow many individual investors to pool smaller amounts of money to invest in specific property projects. It’s a way to get direct exposure to individual properties without needing a lot of capital, which is quite appealing. You can pick and choose the projects you like, giving you a bit more control over your specific investments.

Finally, direct equity investments in property development projects also count. This is where you directly put money into a specific building or land development, often alongside other investors. It can be more hands-on and might involve higher risks, but the potential for profit can also be greater if the project does well. This is more for those who like to be really involved, you know.

Why Consider Real Estate Equities?

People often look at real estate equities for several good reasons, honestly. One big draw is the potential for steady income. Many real estate equity investments, like REITs, pay out regular dividends, which can be a nice source of passive earnings. This can be very attractive for those seeking consistent cash flow from their money.

Another reason is diversification. Adding real estate equities to your investment mix can help spread out your risk. Property markets don't always move in lockstep with stock markets, so having real estate can smooth out your overall portfolio’s performance during market ups and downs. It’s about not putting all your eggs in one basket, as they say.

Real estate can also be a good hedge against inflation. When prices for goods and services go up, property values and rents often rise too. This means your real estate investments can help protect your purchasing power over time, which is a pretty comforting thought during periods of rising costs. It’s a way to keep your money strong, you know.

Moreover, real estate has a tangible quality that some other investments lack. You’re investing in something real, something you can see and touch, like buildings or land. This can give investors a sense of security and understanding that they might not get from purely abstract financial products. It’s a pretty solid asset, apparently.

Brandon Miller's Approach to Real Estate Equities

An approach like Brandon Miller's to real estate equities would typically involve a very disciplined and thoughtful strategy. It’s not about chasing every hot trend, but rather about making informed decisions that stand the test of time. This kind of thinking helps build a resilient portfolio, which is what many investors really need.

Such an approach would prioritize thorough research and a deep understanding of the underlying assets. It’s about looking beyond the surface and truly understanding the value and potential of each property or fund. This means paying attention to details, you know, that others might miss.

It also means having a long-term view. Real estate investments, especially equities, often perform best when given enough time to mature and grow. A Brandon Miller-like strategy would focus on patient capital, letting investments compound over years rather than seeking quick profits. This patient attitude is quite important for success.

Identifying Promising Opportunities

A key part of a Brandon Miller-style strategy involves really knowing how to spot good opportunities. This means looking for properties or funds that have strong fundamentals and a clear path for growth. It’s about finding value where others might not see it right away, you know, a bit like finding a hidden gem.

This often includes analyzing demographic shifts and economic trends. For example, if a certain area is seeing a lot of job growth or population increase, that could mean more demand for housing or commercial spaces. Understanding these broader patterns helps pinpoint areas ripe for investment, which is pretty smart.

It also means evaluating the management teams behind real estate funds or REITs. A strong, experienced management team can make a huge difference in how well an investment performs. They are the ones making the day-to-day decisions, so their expertise is incredibly important, honestly. You want people who know what they are doing.

Considering the type of property is also very important. Are office spaces still a good bet, or is industrial property for logistics more promising right now? Different property types perform differently depending on the market and current needs. A good investor considers these nuances very carefully, you know, to make the best choices.

Risk Management and Diversification

Any smart investment approach, including one like Brandon Miller's, puts a lot of thought into managing risk. It’s not about avoiding risk entirely, which is nearly impossible, but about understanding it and taking steps to lessen its impact. This is really where a solid strategy shines, you know.

Diversification is a core part of this. Spreading your investments across different types of real estate, different geographic areas, or different investment vehicles (like a mix of REITs and crowdfunding) can help reduce the impact if one particular area or asset type performs poorly. It’s like having multiple streams of income, so if one dries up, you still have others.

Regularly reviewing your portfolio is also essential. Market conditions change, and what was a good investment last year might not be the best one this year. Staying informed and making adjustments as needed helps keep your portfolio aligned with your goals and current realities. This active management is quite important, apparently.

Understanding the specific risks associated with each investment is also key. For example, a development project might carry more risk than an established, income-producing property. Knowing these differences helps you make choices that match your comfort level with risk. It’s about being prepared for what might happen, you know, good or bad.

Long-Term Growth Strategies

For someone focusing on long-term growth, like Brandon Miller might, the strategy goes beyond just picking good assets. It involves thinking about how those assets will perform over many years, not just months. This patient outlook is pretty fundamental to success in real estate equities, honestly.

One aspect is reinvesting returns. Instead of taking all your dividends or profits out, putting some back into your investments can help them grow even faster through the power of compounding. This means your money starts earning money on its own money, which is a very powerful concept for wealth building.

Another strategy involves looking for properties or funds that have potential for value-add improvements. This could mean investing in properties that can be renovated, redeveloped, or repurposed to increase their income potential or market value. It’s about seeing the potential for improvement, you know, and making it happen.

Staying informed about broader economic shifts and demographic trends is also important for long-term growth. Understanding where people are moving, what industries are growing, and how technology is changing property use can help you anticipate future demand and make smarter long-term bets. This foresight is quite valuable, apparently.

Getting Started with Real Estate Equities

If you're thinking about getting into real estate equities, it's a pretty good idea to start with some basic steps. You don't need to be an expert right away, but a little preparation can go a long way. It’s about building a solid foundation for your investment journey, you know, one step at a time.

First, figure out what you want to achieve. Are you looking for steady income, long-term growth, or both? Knowing your goals will help you choose the right types of real estate equities and the right investment vehicles. This clarity is quite important for making effective decisions.

Next, educate yourself a bit more about the different options available. Learn about REITs, crowdfunding, and other ways to invest. The more you know, the better equipped you'll be to make choices that fit your financial situation and comfort level. There are many resources out there, like articles and guides, that can help you learn more about real estate investment.</

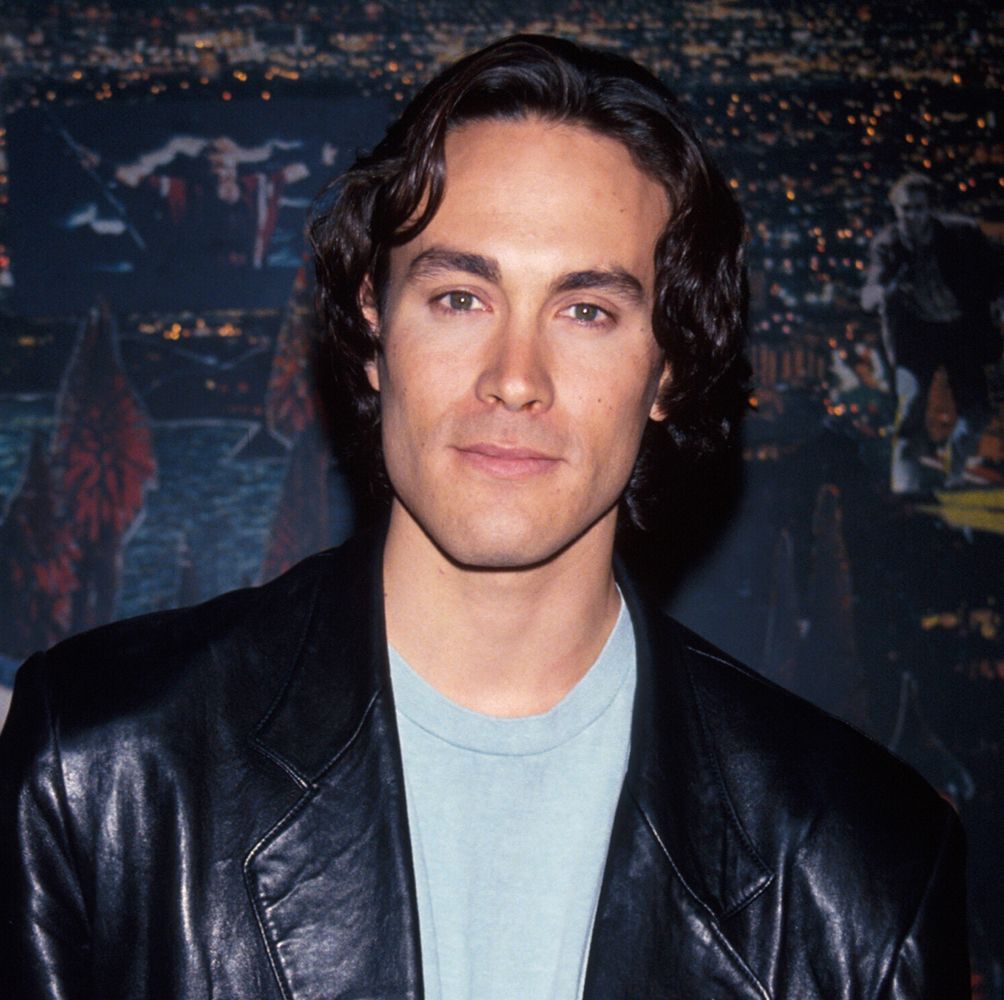

:max_bytes(150000):strip_icc():focal(672x0:674x2)/brandon-lee-1-2000-e0e7967e6ae94da9818f5f2850e13a13.jpg)

Brandon Lee's Family Speaks Out After Rust Accidental Shooting

Brandon Lee’s loved ones remember ‘The Crow’ star 30 years after his

Brandon Lee