Understanding Topside Adjustment: Keeping Your Financial Picture Clear

Detail Author:

- Name : Mylene Pouros

- Username : gina05

- Email : kessler.michel@muller.info

- Birthdate : 1972-08-10

- Address : 95916 Huels Shoal Suite 006 Cecilestad, DC 93995-9505

- Phone : (781) 520-8601

- Company : Wyman-Fritsch

- Job : Precision Printing Worker

- Bio : Et dolor pariatur sequi exercitationem. Sed voluptatum eum rerum et non sequi ducimus architecto. Laborum exercitationem sit vero magni.

Socials

facebook:

- url : https://facebook.com/erdmanm

- username : erdmanm

- bio : Nulla sapiente officiis dolor sapiente commodi nostrum.

- followers : 5622

- following : 346

tiktok:

- url : https://tiktok.com/@merdman

- username : merdman

- bio : Vitae nobis et fuga et tempore id exercitationem.

- followers : 2400

- following : 1205

Have you ever looked at your company's financial reports and felt like something just wasn't adding up? Perhaps you've seen numbers that don't quite match from one period to the next, even without new transactions. This feeling of a slight mismatch, a little bit of a puzzle, often points to something known as a topside adjustment. It's a way businesses make sure their books reflect the true picture, especially when preparing big financial statements.

These kinds of adjustments are a common part of getting your financial house in order. They help bridge gaps that might appear when you combine numbers from different parts of a business or when you are getting ready for an audit. Knowing about them can really help you make sense of how financial records come together, more or less.

So, understanding topside adjustments is pretty important for anyone wanting to get a handle on financial reporting. It helps you see beyond the day-to-day entries and grasp how the bigger financial picture gets put together, you know, for accuracy.

Table of Contents

- What is a Topside Adjustment?

- Why Do We Need Topside Adjustments?

- How Are Topside Adjustments Handled?

- Common Challenges with Topside Adjustments

- Frequently Asked Questions About Topside Adjustments

- Making Sense of Your Financial Numbers

What is a Topside Adjustment?

A topside adjustment, in simple terms, is a change made to financial statements without directly altering the underlying accounting ledger. Topside entries are journal entries that aren't in the ledger. This means the original records stay as they are, yet the final reports show a different number. It’s a bit like putting a note on a drawing to change its meaning, without actually erasing anything on the drawing itself.

Typically there is a list of these entries. Then, the financial statements are manually edited to adjust for them. This practice helps financial teams make sure the final balance sheet and income statement show the right figures. It often happens at the end of a reporting period, like a quarter or a year, when all the numbers are being put together for public viewing. It’s really about presenting the most accurate view.

You might use a topside adjustment when a balance sheet as of December 2022 doesn't match as of the adjustment 2022 period. This happens when there are no transactions posted in the transaction period, yet a variance shows up. I noticed the variance are coming from these kinds of situations, actually.

Why Do We Need Topside Adjustments?

There are several good reasons why a business might need to make a topside adjustment. It's not about hiding things, but rather about showing the full, true financial picture. Sometimes, the way transactions are recorded in different systems just doesn't line up perfectly. This is often the case, you know.

Consolidation Matters

One very common reason for a topside adjustment is when a larger company brings together the financial results of its smaller parts or subsidiaries. When you consolidate, sometimes the equity from a subsidiary might not need to move to the holding company in the general ledger. It's just a topside adjustment. This happens when you consolidate. If there's nothing at the holding company, for instance, this approach makes sense.

These adjustments help ensure that when all the separate financial statements are combined into one big report for the whole group, everything balances out. It's about getting all the pieces of the puzzle to fit together seamlessly, more or less. This is quite a common practice for large organizations, you know.

Fixing the Gaps

Sometimes, a topside adjustment helps correct errors or omissions that were not caught earlier in the accounting process. It’s a way to fix things without going back and changing a whole bunch of individual entries. Drawing a blank on what to do with a topside adjustment we had for FY 2020 that was a debit, for example, is a real situation. You need a way to make it right.

It also addresses differences that come from using different accounting methods across various parts of a business. Or, perhaps, a new accounting rule came out that applies to past periods. A topside adjustment can help apply that rule without redoing all the past records. This is very practical, really.

International Considerations

For companies that operate across different countries, topside adjustments become even more important. Different countries have different accounting rules and currencies. This means that when you bring all those numbers together, you often need to make specific changes. You might need to submit and track all international topside journal entries. This ensures consistency across the global business.

These international adjustments help convert everything into a single, common reporting standard and currency. It’s about making sure that a dollar in one country is treated the same way as a dollar in another, for reporting purposes. This is quite a detailed process, naturally.

How Are Topside Adjustments Handled?

Handling a topside adjustment usually involves a team of experienced accountants. They identify the discrepancy or the need for the adjustment. Then, they prepare a special entry that will only affect the final financial statements. It's not like a regular transaction that goes into the day-to-day ledger, so it is a bit different.

The process often begins with identifying the variance. For instance, if your balance sheet as of December 2022 doesn't match the adjusted period, and there are no new transactions, you know something needs looking at. I noticed the variance are coming from these kinds of situations, so you address them directly.

Once the adjustment is calculated, there is a list of these entries. Then, the financial statements are manually edited to adjust for them. This manual step is key because it bypasses the automated ledger system. This means the original records remain untouched, which can be important for audit trails, you know.

There's also a process to submit and track all international topside journal entries. This makes sure that every necessary change is recorded and can be reviewed later. Proper documentation is very important for these adjustments. It ensures transparency and accountability, too.

Common Challenges with Topside Adjustments

While topside adjustments are a necessary tool, they do come with their own set of challenges. One big challenge is making sure they are used correctly and ethically. Topside accounting adjustments/devices can be an illegal practice where accountants manipulate accounting practices to close gaps between actual operating figures and desired results. This is something to be very careful about, obviously.

Another challenge is simply the manual nature of these adjustments. Since they are often manually edited, there's a higher chance for human error. This means that a financial team needs to be very careful and double-check their work. It requires a lot of attention to detail, honestly.

Also, figuring out the exact amount for a topside adjustment can be tricky. Drawing a blank on what to do with a topside adjustment we had for FY 2020 that was a debit, for example, shows this difficulty. It requires a good understanding of accounting principles and the specific situation. This can be quite a puzzle, actually.

Sometimes, if there's not enough adjustment at the barrel, meaning not enough flexibility in the initial accounting setup, you might find yourself needing more topside adjustments than you would like. This can make the process more cumbersome. It really highlights the need for good initial accounting systems, you know.

Frequently Asked Questions About Topside Adjustments

People often have questions about topside adjustments. Here are some common ones that might help clear things up for you.

What is the main difference between a regular journal entry and a topside adjustment?

A regular journal entry goes directly into the general ledger and changes the core accounting records. A topside adjustment, on the other hand, is a change made to the financial statements *after* the ledger is closed, usually for reporting purposes. Topside entries are journal entries that aren't in the ledger. They don't alter the original books, but they do change what the final reports show. It's like adding a note to a finalized document without changing the original words, you know.

Are topside adjustments always legal?

No, not always. While topside adjustments are a legitimate tool for proper financial reporting, they can be misused. Topside accounting adjustments/devices can be an illegal practice where accountants manipulate accounting practices to close gaps between actual operating figures and desired results. It's very important that these adjustments are transparent, properly documented, and made for legitimate accounting reasons. Any attempt to mislead with them is wrong, obviously.

How do international topside adjustments work?

International topside adjustments help consolidate financial data from different countries, which might have different accounting rules or currencies. You submit and track all international topside journal entries. This ensures that when all the numbers are brought together for a parent company's consolidated report, they are consistent and accurate according to the parent company's reporting standards. It's about making sure everything lines up globally, so.

Making Sense of Your Financial Numbers

Understanding topside adjustments really helps you appreciate the effort that goes into making financial statements clear and accurate. They are a tool for precision, helping to present a true and fair view of a company’s financial health. It’s about making sure all the pieces fit, even when they come from different places or systems, more or less.

For businesses, knowing how to properly use and track these adjustments is very important. It ensures compliance and provides reliable information for making good decisions. This is especially true when dealing with international operations, where submitting and tracking all international topside journal entries is a regular task. It's a critical part of the financial puzzle, you know.

If you're ever faced with a financial discrepancy, remembering the role of topside adjustments can help you figure things out. It’s a common way to reconcile differences, like when a balance sheet as of December 2022 doesn't match an adjustment period, and there are no new transactions. I noticed the variance are coming from these kinds of situations, so understanding this helps. It helps you see how financial reporting gets its final polish, so.

Keeping an eye on these adjustments and making sure they are done correctly means your financial picture stays clear. It's about transparency and accuracy, which are very important for any business. You can learn more about financial reporting standards on our site, and link to this page for best practices in accounting. For more detailed information on specific accounting rules, you might find resources from the International Accounting Standards Board helpful, for instance.

Topside LLC

Topside Bistro | Seafood Restaurant in Gloucester, MA

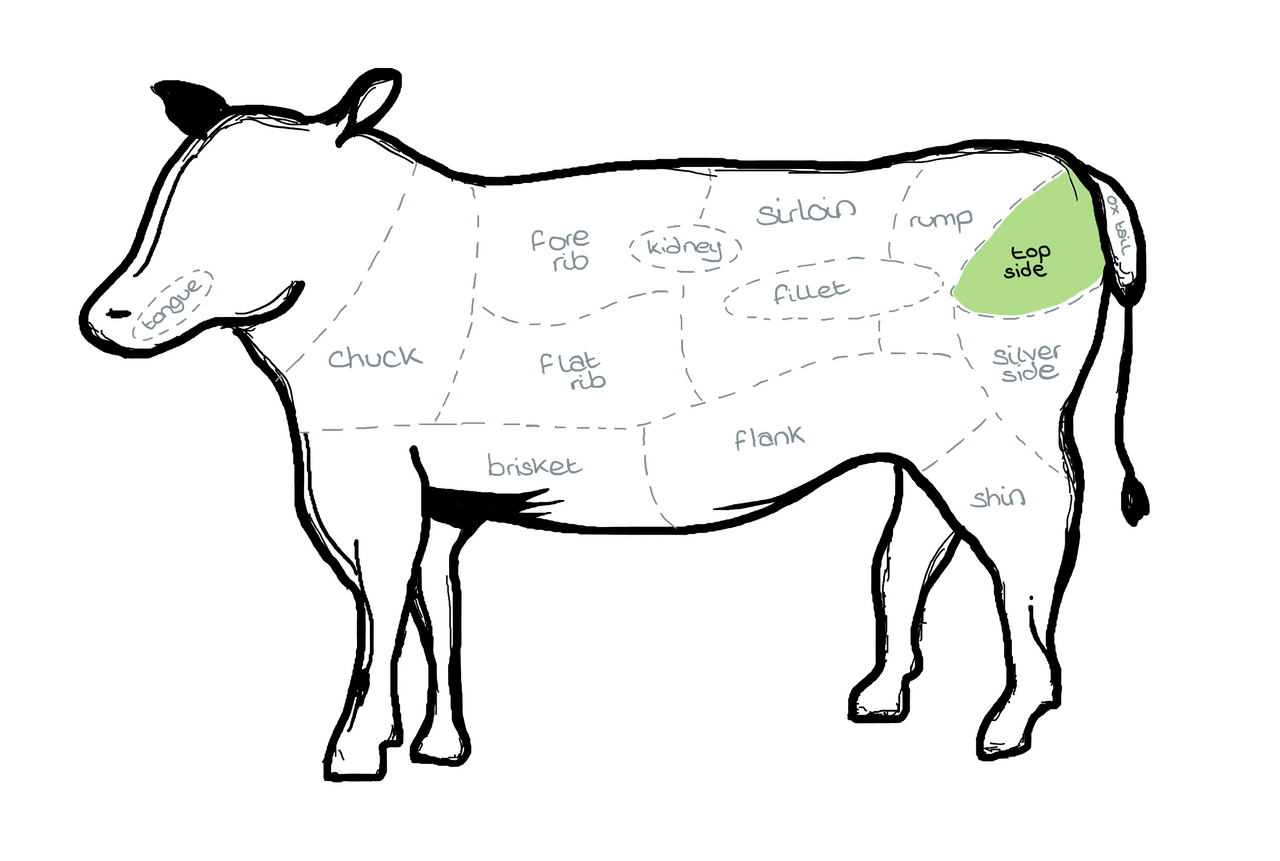

Beef Topside