Discovering Randolph Federal Credit: Your Community Financial Partner

Detail Author:

- Name : Chesley Rodriguez

- Username : jadon89

- Email : ureichert@hotmail.com

- Birthdate : 2004-10-02

- Address : 11857 Christine Estate Suite 876 Sadyemouth, MN 75913

- Phone : 1-458-431-1197

- Company : Waelchi-Nienow

- Job : Architectural Drafter OR Civil Drafter

- Bio : Non illo sit non corrupti exercitationem. Nobis blanditiis et ratione. Velit quo excepturi omnis necessitatibus sed perferendis.

Socials

facebook:

- url : https://facebook.com/phane

- username : phane

- bio : Aut temporibus cupiditate quibusdam consequatur.

- followers : 2518

- following : 2683

tiktok:

- url : https://tiktok.com/@presley.hane

- username : presley.hane

- bio : Nihil rem modi omnis dignissimos incidunt magnam.

- followers : 1962

- following : 1396

Finding a financial partner that truly understands your local needs can make a real difference, you know? For many in our area, the idea of a financial institution that puts people first, rather than just profits, is very appealing. That is exactly what a credit union, like the Randolph Federal Credit, aims to be for its members. It's a place where your financial well-being, and the health of the community around you, really come together.

This particular credit union, Randolph Federal Credit, serves a vibrant area, a suburban city in Norfolk County, Massachusetts, called Randolph. It's a place with a good number of people, around 34,984 folks as of the 2020 census, so there's a lot going on. The city itself adopted a charter effective January 2010, which kind of shows its commitment to its own structure and how things run. A local financial spot, like this credit union, really fits into that sort of community spirit, offering services that are, in some respects, designed for the people who live and work here.

When you think about places like Randolph, you might also think about its educational spots, too. For instance, there's Randolph Community College, where people can complete their high school education or even get a head start on a college degree while still in high school. This kind of community focus on growth and opportunity, which is apparent in the area, aligns pretty well with what a credit union like Randolph Federal Credit typically tries to do. They often look to help people grow their own economic opportunities, which is a big thing for any community, honestly.

Table of Contents

- What is Randolph Federal Credit?

- Why Choose Randolph Federal Credit?

- Services Offered at Randolph Federal Credit

- Becoming a Member

- Common Questions About Randolph Federal Credit

What is Randolph Federal Credit?

Randolph Federal Credit is, at its core, a financial cooperative. This means it is owned by its members, not by outside shareholders looking for big profits. This setup is quite different from a regular bank, you know? The main goal for a credit union is to serve its members' financial needs, often by providing lower loan rates and higher savings rates compared to other types of financial places. It’s a model that has been around for a good while, actually, and it tends to put the member’s benefit first.

The Credit Union Difference

The distinction between a credit union and a bank is pretty significant. Banks are typically for-profit businesses, aiming to make money for their investors. Credit unions, on the other hand, are not-for-profit organizations. Any money made goes back to the members, often through better rates on loans or savings, or by improving services. This structure means that when you are a member of Randolph Federal Credit, you are also a part-owner, so to speak. This gives you a say, in a way, in how the institution operates, which is a rather unique thing in the financial world.

This cooperative spirit is something that can really benefit the local population. For people in Randolph, Massachusetts, having a financial institution that is focused on their success rather than just making money for distant shareholders can be a source of comfort. It is about building a financial community, you know, where everyone helps each other out. That sort of approach can really foster a sense of belonging and mutual support, which is often what local communities are all about.

Why Choose Randolph Federal Credit?

Choosing where to keep your money or get a loan is a pretty big decision for anyone. For folks in Randolph, picking a place like Randolph Federal Credit often comes down to a few key reasons. One big reason is the focus on the local area. This credit union isn't just some big, impersonal corporation; it's a part of the very fabric of the Randolph community. That connection means they often have a better sense of what the people living there really need, which is a good thing.

Local Focus and Community Ties

The city of Randolph, with its population of over 34,000, is a place where local connections matter. Randolph Federal Credit, being a part of this community, understands the specific financial needs and goals of its residents. They are not just looking at numbers; they are looking at people, their neighbors, and their friends. This kind of local commitment can mean more personalized service and a willingness to work with members on an individual basis. It’s a different feel than what you might get from a really big bank, where you are just one of many, so to speak.

The credit union’s presence in Randolph also means that the money you deposit or the interest you pay on a loan stays within the community, more or less. This helps support the local economy in various ways. It is a bit like how Randolph College prepares students to engage the world creatively and live honorably; a local credit union helps its members engage their financial world honorably, and it supports the local economic landscape. This sort of local financial support is pretty important for a town’s overall health and well-being, actually.

Supporting Local Economic Opportunities

A credit union like Randolph Federal Credit often plays a role in enlarging the economic opportunities for people in the area. This is a bit like the broader idea of providing people with remunerative employment or stimulating greater efforts in striving for a better life. By offering fair loan rates for homes, cars, or even small businesses, they help individuals and families achieve their financial goals. This support can lead to more jobs, more local spending, and a generally stronger economic base for Randolph. It is a very practical way to help the community grow, you know?

Think about someone trying to get a head start on a college degree while still in high school, perhaps through Randolph Community College. They might need to save money, or maybe even get a small student loan later on. A local credit union is often right there to help with those kinds of financial steps. They are, in a way, partners in people's life journeys, offering financial guidance and products that can make a real difference. That kind of support is pretty valuable for anyone trying to build a good future.

Services Offered at Randolph Federal Credit

Just like any good financial institution, Randolph Federal Credit offers a range of services designed to help its members manage their money. These services are typically tailored to meet the everyday needs of individuals and families, and sometimes even small businesses in the Randolph area. They are there to help you save, spend, and borrow responsibly, which is a big part of financial health for anyone, honestly.

Savings and Checking Accounts

For most people, the first step in managing money is having a place to keep it safe and accessible. Randolph Federal Credit provides various types of savings accounts, which can help members put money aside for future goals, whether it is for a new home, a child's education, or just a rainy day fund. These accounts often come with competitive interest rates, which means your money can grow a little bit over time. It's a fundamental service, but a very important one, you know?

Checking accounts are also a key offering. These accounts allow members to handle their daily transactions, pay bills, and manage their income. Many credit unions, including Randolph Federal Credit, offer checking accounts with few or no monthly fees, which can be a big benefit for people looking to save money on banking costs. They also often come with features like online banking and mobile apps, making it easy to manage your money from anywhere, which is very convenient in today's world, apparently.

Loan Options for Members

When you need to borrow money, Randolph Federal Credit is typically there to help. They offer a variety of loan products, often with rates that are more favorable than what you might find at other places. This could include loans for buying a car, getting a mortgage for a home in Randolph, or even personal loans for other needs. The focus is usually on helping members achieve their goals in a financially sound way. They are, in a way, a resource for people looking to make big purchases or handle unexpected costs.

Since the credit union is member-owned, the profits from loans go back into the credit union to benefit all members, rather than going to external shareholders. This structure often allows them to offer more flexible terms and lower rates on their loan products. It is a benefit that can really add up over the life of a loan, saving members a good bit of money, actually. This is a core part of the credit union philosophy: helping members thrive financially.

Becoming a Member

Joining Randolph Federal Credit is usually a straightforward process, but there are typically some eligibility requirements you need to meet. Since credit unions are member-owned, they have what is called a "field of membership." This defines who can join and benefit from their services. For Randolph Federal Credit, this field of membership would typically focus on people who live, work, or have some other connection to the Randolph, Massachusetts area, or perhaps a specific group of people like employees of certain companies or organizations.

Who Can Join?

The eligibility for joining Randolph Federal Credit would likely include residents of Randolph, Massachusetts, and perhaps its immediate surrounding towns. It could also extend to people who work in Randolph, or even those who are related to current members. For instance, if you live in Randolph, or maybe you work at a business on Radtke Road or Railroad Avenue, you might be eligible. It’s all about serving the community it is named after, more or less. You would need to check their specific criteria, but it tends to be pretty broad for local credit unions.

Sometimes, there are also connections to educational institutions. For example, if you are a student at Randolph Community College, or even if you are associated with Randolph College, which prepares students to engage the world critically, there might be a pathway to membership. The idea is to create a strong, connected financial community, and including various groups from the area helps achieve that. It's a way to ensure that the benefits of the credit union are accessible to a wide range of people in the local area, which is a good thing.

The Membership Process

Once you confirm you meet the eligibility requirements, becoming a member of Randolph Federal Credit is usually pretty simple. It typically involves opening a basic savings account, which establishes your membership share in the credit union. This initial deposit is often a small amount, just a few dollars, and it makes you a part-owner of the credit union. From there, you can access all the other services they offer, like checking accounts, loans, and other financial products.

The process usually involves filling out an application, providing some identification, and making that initial deposit. It’s designed to be as easy as possible, so that more people can join and take advantage of the benefits of a member-owned financial institution. You can often start the process online, or by visiting a local branch if they have one. It's a straightforward path to becoming a part of a financial group that truly puts its members first, which is really what it is all about, you know?

Common Questions About Randolph Federal Credit

People often have questions when they are thinking about a new financial institution, especially a credit union. Here are a few common inquiries you might have about Randolph Federal Credit, which aim to give you a clearer picture of what they offer and how they operate, honestly.

Is Randolph Federal Credit like a bank?

While Randolph Federal Credit offers many of the same services as a bank, like checking and savings accounts or loans, it's actually quite different in its structure. It is a not-for-profit cooperative owned by its members, rather than a for-profit corporation owned by shareholders. This means any earnings go back to the members through better rates or lower fees, which is a key distinction, you know? It's a very people-focused approach to finances, in a way.

How do I know my money is safe at Randolph Federal Credit?

Your money at Randolph Federal Credit is typically very safe. Federal credit unions are usually insured by the National Credit Union Administration (NCUA), which is a U.S. government agency. This insurance protects your deposits up to at least $250,000 per member, per account ownership type, which is similar to how the FDIC insures banks. This provides a strong level of security for your funds, so you can feel pretty confident about keeping your money there, actually. You can learn more about federal credit union insurance from the NCUA directly.

Can students from Randolph College or Randolph Community College join?

Membership eligibility for Randolph Federal Credit often includes individuals who live, work, or study in the Randolph area. So, students attending Randolph College or Randolph Community College might very well be eligible to join, depending on the specific field of membership rules set by the credit union. It's a good idea for students to contact the credit union directly to confirm their eligibility and see what options are available to them. They often have services that are useful for students, you know? Learn more about community financial options on our site, and link to this page financial literacy for students for more help.

Randolph (Massachusetts) – Wikipedia

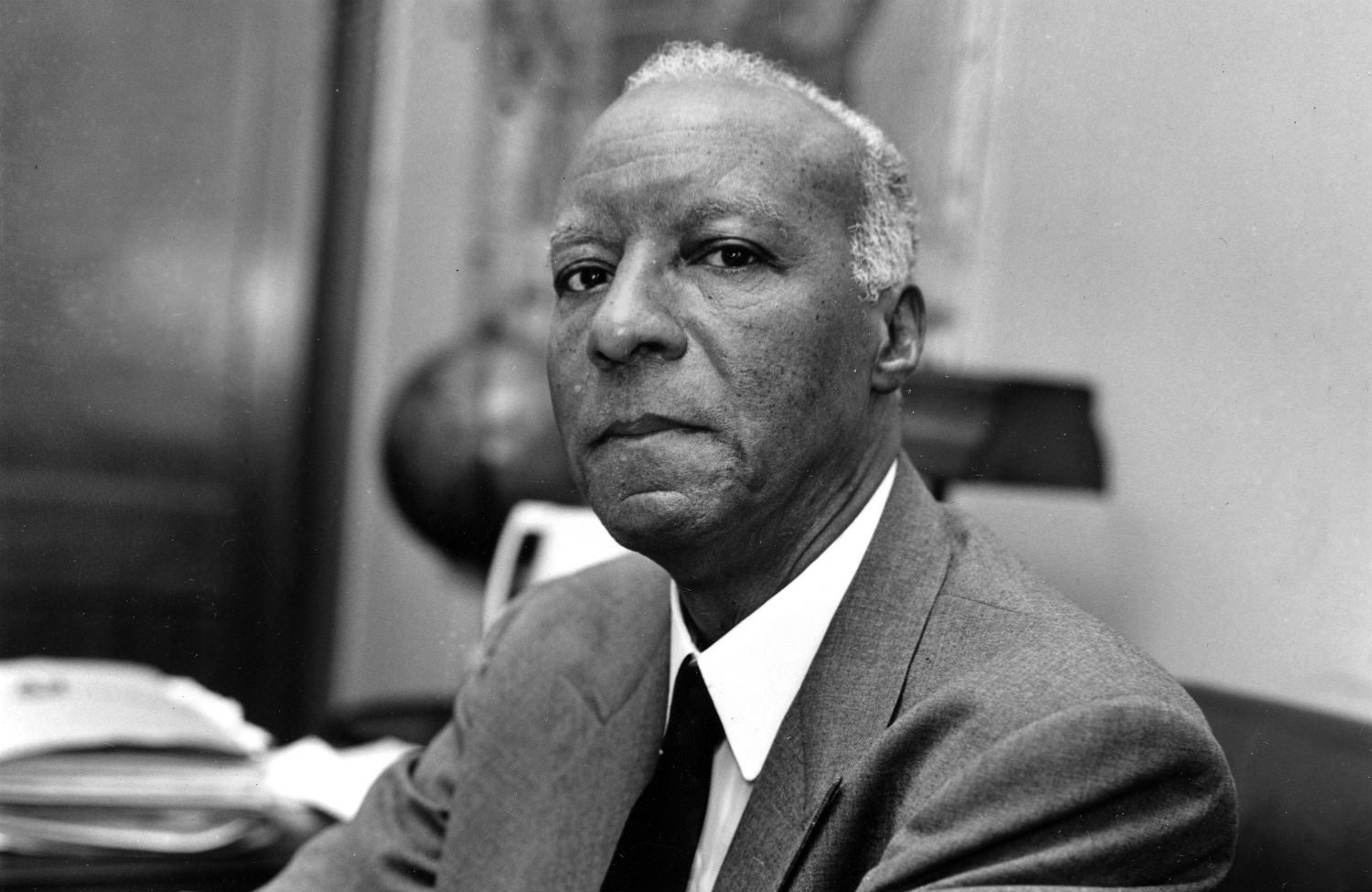

A. Philip Randolph Was Right: ‘We Will Need To Continue Demonstrations

Randolph Scott - Turner Classic Movies